A. INTRODUCTION OF JOB CREATION LAW

On 5 October 2020, the House of Representatives passed Law No. 11 of 2020 on Job Creation (“Job Creation Law”), which was signed by the President on 2 November 2020 and came into force on the day of its publication on the same date. With that, we have prepared this Practical Briefing to help you understand salient issues for practical and tactical application of the newly enacted Job Creation Law in your business.

The Job Creation Law is often called the “Omnibus Law”, which is not an accurate reference. “Omnibus Law” is merely a general term that is used to describe any law that seeks to amend or revoke several statutes in one bill. Job Creation Law, on the other hand, is the actual title of the new Law No. 11 of 2020, which happens to use the omnibus concept, i.e. a law that seeks to amend or revoke several statues at once. In addition to the Job Creation Law, there are other bills that are intended to be made using the “Omnibus Law” concept and have been included in the 2020-2024 National Legislation Program (Program Legislasi Nasional), including the bill on Tax Provisions and Facilities for Economic Strengthening.

Upon its publication on 2 November 2020, this 1187-page law consisting of 15 chapters and 186 articles effectively amended 76 laws and revoked two laws. The list of affected laws is attached in this letter. In the absence of clear implementing regulations, however, we foresee some real challenges in the actual implementation of the Job Creation Law. We note that the Job Creation Law mandates the relevant government authorities to craft the various implementing regulations within a period of three months from the time the Job Creation Law came into force on 2 November 2020. See https://uu-ciptakerja.go.id/category/draft-rpp/ for more information regarding the development of the implementing regulations.

B. SCOPE AND OBJECTIVES OF JOB CREATION LAW

As the name suggests, the Job Creation Law was made with the objective of increasing Indonesia’s competitiveness and creating more job opportunities amid the rising competitive economy and globalization. It focuses in strengthening the backbone of Indonesia’s economy, i.e., job creation, cooperatives, micro, small and medium enterprises, as well as investments. To achieve this objective, the Job Creation Law introduces new systems for improving the investment and business ecosystem, adjusts some aspects of employment, and modifies various regulations, to provide ease of doing business and business licensing. These key features are the most important aspects among other clusters covered by the Job Creation Law. In essence, the Job Creation Law is a true breakthrough which conveys a message of optimism and reflects a cooperative, instead of polarized, characteristic of Indonesian businesses.

The enactment of the Job Creation Law could not have come at a better time, as scores of investors pull out of China as a result of the US-China trade war. This provides a great opportunity for Indonesia – with its new framework for a proper and efficient way of doing business in the country – to lure these investors into relocating to Indonesia.

C. CHALLENGES OF JOB CREATION LAW

Some foreseeable challenges of the implementation of Job Creation Law include:

- As mentioned, the Job Creation Law mandates government authorities to formulate various implementing regulations (either “Government Regulation” or “Presidential Regulation”) of the Job Creation Law within three months after it officially came into force. This means that there will be a gap when norms are either unsettled or unenforceable pending the issuance of the implementing regulations. Concurrently, there will be dozens of government regulations to draft in a short span of time which may cast doubt on the reliability of such regulations, especially since there are already allegations that the Job Creation Law itself was drafted rather carelessly;

- The new law also potentially faces a constitutional challenge due to the changes that were made to the draft after it was approved by the House of Representatives, as well as some structural errors in some cross-references; and

- The Job Creation Law’s effort to digitalize licensing and business processes may not be supported by adequate infrastructures at the moment, that technical errors and glitches might be expected. Therefore, despite its noble objective, the Job Creation Law’s actual implementation may not be easy, and there is that possibility that the Job Creation Law might be struck down as invalid or unconstitutional by the Constitutional Court.

D. EFFECT OF JOB CREATION LAW FOR YOUR PROPOSED TRANSACTION

Effect of the Job Creation Law to M&A, Capital Market and Investment Transaction in Indonesia

Set forth below are some material highlights of the Job Creation Law that may affect your M&A, Capital Market and Investment transactions:

1. NEW POTENTIAL APPROACH ON NEGATIVE INVESTMENT LIST

The Job Creation Law indicates a new approach on the negative investment list, which no longer differentiates between foreign and domestic investors, but only lists sectors that are open or closed for investment (whether domestic or foreign investment). Nonetheless, this is subject to the Presidential Regulation that will be issued within three months from the enactment date of the Job Creation Law (i.e. three months from 2 November 2020).

2. REVOCATION OF NUISANCE LAW AND MANDATORY COMPANY REGISTRATION LAW

For the purpose of legal due diligence, in particular for capital market transactions, since the Job Creation Law has revoked the Nuisance Law and Mandatory Company Registration Law, there is no longer a requirement to obtain a nuisance permit or make a mandatory company registration (except for registration of company’s data in the Ministry of Law and Human Rights).

3. SIMPLIFICATION OF BUSINESS LICENSING

Due to simplification of the licensing process, certain licenses that were previously required prior to obtaining a business license, such as location permit and environmental license, are no longer required.

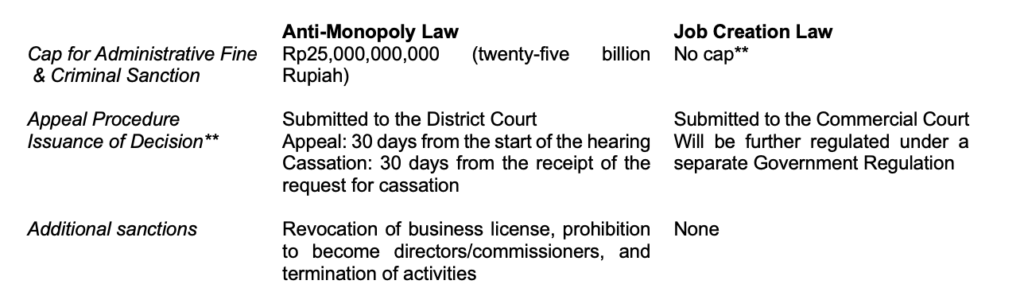

4. REMOVAL ON PENALTY CAP

For M&A transactions that will trigger the post-acquisition notification obligation to the Supervisory Business Competition Committee (Komisi Pengawasan Persaingan Usaha or “KPPU”), while previously the amount of fines was capped at Rp25,000,000,000 (twenty-five billion Rupiah), now based on the Job Creation Law there is no longer any cap on the amount of fines (Note: Any delay of post-acquisition notification to KPPU will be subject to Rp1,000,000,000 (one billion Rupiah) per day).

You may also read our joint write up with WongPartnership on the new Indonesian merger control guidelines at this link.

5. SEVERANCE PAYMENT REDUCTION ON TERMINATION DUE TO M&A

The Job Creation Law simplifies the calculation of severance payments in the event of employment termination due to M&A. Previously, if there is termination due to M&A, the employer must pay 2x the severance formula set out in the Manpower Law. Under the Job Creation Law, such requirement has been deleted, and therefore the employer’s obligation is only to pay severance payment in accordance with the severance formula (i.e. no longer 2x).

6. IN-KIND CONTRIBUTION (INBRENG) NO LONGER SUBJECT TO VALUE ADDED TAX (VAT)

Transfer of taxable goods for the purpose of capital injection, or in-kind contribution (inbreng), provided that both transferor and transferee are taxable entrepreneurs (pengusaha kena pajak) is no longer subject to VAT.

7. DIVIDEND DISTRIBUTIONS ARE EXEMPTED FROM INCOME TAX

Corporate taxpayers are exempted from income tax for dividends distributed by local companies, while individual taxpayers are exempted for so long as such distributed dividends are invested in Indonesia for a certain period of time. As for dividends distributed by foreign companies, both corporate and individual taxpayers are exempted if at least 30% of the after-tax net income is invested in Indonesia.

8. REDUCTION ON INCOME TAX ARTICLE 17 (PPh 17) FOR CORPORATION

The Job Creation Law complements incentives provided by the earlier Law No. 2 of 2020, which provides for fiscal stimulus in response to the COVID-19 outbreak by reducing corporate income tax for domestic taxpayers and permanent establishments (bentuk usaha tetap) to 22% (for fiscal years 2020 & 2021) and 20% (for fiscal year 2022 onwards). Furthermore, domestic limited liability companies, 40% of the total issued shares of which are traded in the Indonesia Stock Exchange (“IDX”), are given an additional 3% reduction, amounting to as low as 17% income tax rate starting 2022.

9. OVERSEAS ELECTRONIC COMMERCE IS SUBJECT TO TAX OBLIGATION

In addition to the foregoing, Law No. 2 of 2020 also stipulates that intangible goods and services from outside of Indonesia which are traded electronically will be subject to VAT, and electronic transactions conducted by foreign tax payer will be subject to income tax.

10. INCOME TAX EXEMPTION FOR EXPATRIATES

Foreign-sourced income of expatriates who have been Indonesian taxpayers is exempted from income tax for the first four years of being Indonesian taxpayers, provided that these expatriates possess certain expert skills.

11. INTRODUCTION OF DUAL CLASS OF SHARES FOR PUBLIC LISTED COMPANIES

In line with the spirit of the Job Creation Law, the support for Start-up and E-Commerce Companies, and also to be more competitive with other international recognized stock markets, IDX will soon introduce the creation of Multiple Voting Shares for founders/sponsors of Unicorn Start-up and E-Commerce Companies. This new introduction will allow founders/sponsors who are the key driving force of these companies, to have special rights for the nomination and appointment of members of the Board of Directors and Board of Commissioners, as well as certain other strategic issues such as dividend declaration, on these companies which generally are not attached to the other class of shares of these companies. These special rights will be subject to a certain period of application. Further, certain requirements for listing on the main board of IDX, such as amount of Profit Before Tax and Net Asset, will also be relaxed to support the spirit of the Job Creation Law.

For more details on such material highlights please see the following sections.

E. CHANGES IN JOB CREATION LAW

In this newsletter, we will only discuss relevant material changes that are likely to have an impact on your business. Provisions that are subject to further implementing regulations are signed with double asterisk “**” for your ease of reading. For more details on Job Creation Law, please contact us at optimismindonesia@makeslaw.com.

Investment and Business Ecosystem Improvement

The Job Creation Law aims to increase the investment and business ecosystems through (i) implementing risk-based business licensing, (ii) simplifying primary requirements for business licensing, (iii) simplifying sectoral business licensing, and (iv) simplifying investment requirements.

Risk-Based Business Licensing**

Business licensing requirement is now determined based on the following categories:

1. Low Risk – only requires a Business Identification Number (Nomor Induk Berusaha or “NIB”);

2. Medium Risk – requires a Standard Certification in addition to NIB, which is further differentiated into:

- Medium to low risk: in a form of a statement by the business owner hat it has fulfilled the requirements to conduct its business activities; and

- Medium to high risk: issued by the Central or Regional Government based on verification on the fulfillment of the requirements to operate business activities; and

3. High Risk – requires a Business License and Standard Certification, if applicable, to operate. in addition to NIB.

Primary Business Licensing**

Primary business licensing covers:

1. Conformity of spatial utilization – Certain spatial utilization licenses, such as location permit, land utilization permit, and principle license, are no longer mandatory under the Job Creation Law. Instead, businesses have to obtain confirmation on spatial utilization activity compatibility (kesesuaian kegiatan pemanfaatan ruang) from the Central Government based on the detailed spatial plan (Rencana Detil Tata Ruang) provided by the Regional Government in digital form. Such a confirmation would be uploaded and integrated in the business licensing system (OSS);

2. Environmental approval – Environmental license, which was mandatory under the Environmental Law as a prerequisite to obtain a business license, is no longer a requirement. To obtain a business license under the Job Creation Law, businesses that are significantly impacting the environment are only required to obtain an Environmental Feasibility Decree from the Central or Regional Government based on an Environmental Impact Assessment (Analisis Mengenai Dampak Lingkungan Hidup or “AMDAL”). As for businesses with no significant effect to the environment, they only need to provide a statement letter regarding their commitment to conduct environmental management and monitoring as fulfillment of the Environmental Management Effort and Environmental Monitoring Effort (Upaya Pengelolaan Lingkungan Hidup – Upaya Pemantauan Lingkungan Hidup or UKL-UPL) standard; and

3. Approval of building and eligibility to function certificate – The former building construction permit (Izin Mendirikan Bangunan or IMB) is now replaced with a building approval (Persetujuan Bangunan Gedung or PBG), while the certificate of worthiness (Sertifikat Laik Fungsi) is still required. Under the Job Creation Law, both building approval and certificate of worthiness will be issued by the electronic business licensing system (OSS).

Investment**

Under the Job Creation Law, all business fields are open for investment except the ones that are closed for investments, or which can only be conducted by the Central Government. This suggests a shift from the previous subjective approach, which emphasizes on the subjects doing the investment, to an objective approach by focusing on business sectors that are open for investment or not (regardless of domestic or foreign investment). However, it is still uncertain on how the government will further regulate the foreign investment restriction following this Job Creation Law (i.e. whether there will still be a negative list of investment or not). This would become clearer once the Presidential Regulation becomes available.

Sectoral Business Licensing

Some changes on sectoral business licensing were made on the following business sectors: (a) marine and fisheries, (b) agricultures, (c) forestry, (d) mining, (e) nuclear, (f) industrial, (g) trade and compliance standardization, (h) public housing, (i) transportation, (j) health, drugs and food, (k) education and culture, (l) tourism, (m) religious, (n) post, telecommunication and broadcasting, and (o) defense and security. Please contact us at optimismindonesia@makeslaw.com for more information on specific sectors.

Manpower

Foreign Manpower

Employers who employ foreign manpower must have a foreign manpower utilization plan (Rencana Penggunaan Tenaga Kerja Asing or RPTKA) approved by the Central Government, except for foreign manpower that is needed by an employer whose business is stopped due to an emergency, or those involved in vocational activities and tech-based startups, or those doing a business visit and a time-limited research.

Temporary Employment Agreement (Perjanjian Kerja Waktu Tertentu or “PKWT”)**

Non-compliance with requirements regarding PKWT, including the requirement that a PKWT should not contain a probation period, will result in the PKWT being deemed as a permanent employment agreement (Perjanjian Kerja Waktu Tidak Tertentu or PKWTT). Further, the Job Creation Law requires employers to compensate employees for their time of service when the PKWT expires in an amount to be further stipulated under the Government Regulation.

Outsourcing

The Job Creation Law no longer limits the job criteria that may be outsourced. As for outsourcing companies, the Job Creation Law mandates them to be fully responsible in protecting the rights of outsourced workers.

Working Hour, Rest Time and Paid-Leave

Provided that there is a prior consent from employees to work overtime, which remains consistent with the provision under the Manpower Law, the Job Creation Law now increases the maximum permitted overtime hours to four hours in a day or to 18 hours in a week. It also removed the long service leave entitlement for employees with six consecutive years of service. Nevertheless, it allows the employer and the employee to mutually agree on such entitlement in the employment agreement, company regulation or collective labor agreement.

Wage

Employers must pay wages in accordance with the agreement between employers and employees or labor union, which shall in no case be lower than the regional minimum wage provision. Employers who delay in paying wages, whether on purpose or by negligence, are subject to fines based on a percentage of the workers’ wage.

Termination**

The Job Creation Law shortens the termination process by taking out requirements for an employer (i) to obtain a prior court approval and (ii) to give warning letters for employees due to any violation of the relevant employment agreement or company regulation. Nevertheless, the Job Creation Law does not reduce the rights of employees in general. In addition, it introduces new grounds for a valid termination of employment by the employee, such as in the case of: (i) a spin-off, (ii) a petition by its creditors for suspension of debt payment obligation (penundaan kewajiban pembayaran utang or PKPU), or (iii) declaration of bankruptcy. Further provision on the termination process will be stipulated under the Government Regulation.

Severance

The Job Creation Law provides the same severance payment calculation formula as set out in Article 156 of the Manpower Law. However, there are three main differences, which are (i) the Manpower Law states that the severance amount is “at least” as regulated under the Manpower Law, while the Job Creation Law removed the phrase “at least” which means that the terminated employees should not have the right to demand the severance more than the amount under the given formula; (ii) the Job Creation Law has removed the requirement of the company to pay separation payment (uang pisah) to an employee who resigns voluntarily, and (iii) the Job Creation Law removed the requirements for employers to pay housing, medical and healthcare allowances upon termination of employment, which based on Manpower Law should be in an amount representing 15% of the total severance payment and reward of service payment.

Sanctions

The Job Creation Law provides sanctions for employers who do not pay wage payments in accordance with the terms of the relevant employment agreements (and in any case no less than the minimum wage), or severance payments in accordance with relevant regulations.

Ease of Doing Business

Immigration Law

1. Electronic Visas & Stay Permits

The Job Creation Law has extended the definitions of Visa and Stay Permit to acknowledge electronic forms. As a result, an Indonesian Visa and Stay Permit can now be issued physically or electronically by the relevant authority.

2. Scope of Eligible Persons and Activities under Visas & Permits

The Job Creation Law extends the scope of various visas/permits by adding on to the list of eligibilities and permitted activities, as follows:

3. Limited Stay Permits

Foreigners can now obtain Limited Stay Permits directly at immigration checkpoints, thus will no longer be required to apply for the permit at the local immigration office in their home countries.

4. Guarantors of Foreigners**

The Job Creation Law provides for the following additional exemptions to the requirement that foreigners must have guarantors in Indonesia:

(a) Foreigners investing in Indonesia; and/or

(b) Foreigners whose country of origin applies a reciprocal exemption for Indonesian national.

Company Law

1. Minimum Shareholders

Job Creation Law expands the list of businesses that are exempted from the requirement of having a minimum of two shareholders by including micro and small enterprises (MSEs), which means that MSEs may be established by only one shareholder.

2. Authorized Capital**

Consistent with Government Regulation No. 29 of 2016 on Amendment of Company’s Authorized Capital, the Job Creation Law does not require a minimum authorized capital of Rp50,000,000 (fifty million Rupiah) and, instead, allows the founders of a company to agree on the minimum capitalization of the company. However, this excludes certain business sectors that have specific requirements on the minimum amount of capital as regulated in other laws and regulations.

Anti-Monopoly Law

Below are important amendments to the Anti-Monopoly Law:

Nuisance Law and Mandatory Company Registration Law

The Job Creation Law revokes Nuisance Law and Mandatory Company Registration Law and therefore businesses are no longer required to obtain a nuisance permit or register the company information to the registration office

Land Procurement

Establishment of Land Bank**

To guarantee the availability of land for the public, and for social and national development, economic equality, land consolidation, and agrarian reform, the Job Creation Law requires the establishment of a land bank agency. This land bank agency’s assets may come from the state budget (Anggaran Pendapatan dan Belanja Negara or APBN), personal income, and state equity participation. A land which is managed by a land bank agency is given a right to manage (Hak Pengelolaan or “HPL”), and may be granted with a right to cultivate (Hak Guna Usaha or “HGU”), right to build (Hak Guna Bangunan or “HGB”) and right to use (Hak Pakai or ”HP”) over the HPL.

Strengthening of Right to Manage**

HPL, which was not explicitly regulated under the Agrarian Law, is now expressly regulated by the Job Creation Law. The Job Creation Law includes a land bank agency as one of the parties who may hold an HPL in addition to the Central Government agencies, Regional Governments, land bank agencies, State Owned Enterprises/Region Owned Enterprises, state owned legal entity/regional owned legal entity, or legal entity appointed by the Central Government.

Apartment Unit for Foreigners

Formerly, foreigners (with stay permits) were only able to own strata title on right to use (hak pakai atas satuan rumah susun) of apartment units. Currently, the Job Creation Law allows (i) foreign citizens with relevant permit, (ii) foreign legal entities with representative offices in Indonesia, and (iii) representatives of foreign countries and international institutions in Indonesia, to own a strata title right of ownership (hak milik atas satuan rumah susun or “HMSRS”) of an apartment unit. However, the HMSRS for foreign citizens and foreign legal entities will only be granted in a special economic zone, free trade zone, industrial zone and other economic zones.

Full period of HGB

Apartments may be built on (i) HGB or HP land over state owned lands, or (ii) HGB or HP over HPL land. An HGB for apartments that have obtained a certificate of worthiness (Sertifikat Laik Fungsi) may be granted for up to 50 years (inclusive of extensions), as opposed to 30 years and 20 years extension as previously regulated.

Land Rights/Right to Manage on Spaces above Land and Basements**

In this section, the use of land space is divided into two, namely the space above the ground and the space under the ground (basement) where for such purposes, the government may grant an HGB, HP, or HPL. The Job Creation Law further stipulates that the utilization of land on the ground and underground can be given to separate owners.

SCHEDULE

LIST OF AFFECTED LAWS

Investment and Business Ecosystem Improvement

1. Law No. 26 of 2007 on Spatial Planning;

2. Law No. 27 of 2007 on Management of Coastal Areas and Small Islands as amended by Law No. 1 of 2014 on Amendment of Law No. 27 of 2007 on Management of Coastal Areas and Small Islands;

3. Law No. 32 of 2014 on Marine;

4. Law No. 4 of 2011 on Geospatial Information;

5. Law No. 32 of 2009 on Environmental Protection and Management (“Environmental Law”);

6. Law No. 28 of 2002 on Building;

7. Law No. 6 of 2017 on Architects;

8. Law No. 31 of 2004 on Fisheries as amended by Law No. 45 of 2009 on Amendment of Law No. 31 of 2004 on Fisheries;

9. Law No. 39 of 2014 on Plantation;

10. Law No. 29 of 2000 on Protection of Plant Varieties;

11. Law No. 22 of 2019 on Sustainable Agricultural Cultivation System;

12. Law No. 19 of 2013 on Protection and Empowerment of Farmers;

13. Law No. 13 of 2010 on Horticulture;

14. Law No. 18 of 2009 on Animal Husbandry and Animal Health as amended by Law No. 41 of 2014 on Amendment of Law No. 18 of 2009 on Animal Husbandry and Animal Health;

15. Law No. 41 of 1999 on Forestry as amended by Law No. 19 of 2004 on Enactment of Government Regulation in lieu of Law No. 1 of 2004 on Amendment of Law No. 41 of 1999 on Forestry;

16. Law No. 18 of 2013 on Prevention and Eradication of Forest Destruction;

17. Law No. 4 of 2009 on Mineral and Coal Mining as amended by Law No. 3 of 2020 on Amendment of Law No. 4 of 2009 on Mineral and Coal Mining;

18. Law No. 22 of 2001 on Oil and Gas;

19. Law No. 21 of 2014 on Geothermal;

20. Law No. 30 of 2009 on Electricity;

21. Law No. 10 of 1997 on Nuclear;

22. Law No. 3 of 2014 on Industry;

23. Law No. 7 of 2014 on Trade;

24. Law No. 2 of 1981 on Metrology;

25. Law No. 33 of 2014 on Halal Product Assurance;

26. Law No. 1 of 2011 on Public Housing and Settlement Areas;

27. Law No. 20 of 2011 on Apartments;

28. Law No. 2 of 2017 on Construction Service;

29. Law No. 17 of 2019 on Water Resources;

30. Law No. 22 of 2009 on Road Transportation Traffic;

31. Law No. 23 of 2007 on Railways;

32. Law No. 17 of 2008 on Shipping;

33. Law No. 1 of 2009 on Aviation;

34. Law No. 36 of 2009 on Health;

35. Law No. 44 of 2009 on Hospital;

36. Law No. 5 of 1997 on Psychotropics;

37. Law No. 35 of 2009 on Narcotics;

38. Law No. 18 of 2012 on Food;

39. Law No. 33 of 2009 on Film;

40. Law No. 10 of 2009 on Tourism;

41. Law No. 8 of 2019 on Hajj and Umrah Provisions;

42. Law No. 38 of 2009 on Postal;

43. Law No. 36 of 1999 on Telecommunication;

44. Law No. 32 of 2002 on Broadcasting;

45. Law No. 16 of 2012 on Defense Industry;

46. Law No. 2 of 2002 on Police;

47. Law No. 25 of 2007 on Investment;

48. Law No. 7 of 1992 on Banking as amended by Law No. 10 of 1998 on Amendment of Law No. 7 of 1992 on Banking; and

49. Law No. 21 of 2008 on Syariah Banking.

Manpower

50. Law No. 13 of 2003 on Manpower (“Manpower Law”);

51. Law No. 40 of 2004 on National Social Security System;

52. Law No. 24 of 2011 on Social Security Administrative Body (Badan Penyelenggara Jaminan Sosial); and

53. Law No. 18 of 2017 on Protection of Indonesian Migrant Workers.

Ease, Protection, as well as Empowerment of Cooperative, Micro, Small and Medium Enterprises

54. Law No. 25 of 1992 on Cooperatives;

55. Law No. 20 of 2008 on Micro, Small, and Medium Enterprises; and

56. Law No. 38 of 2004 on Road.

Ease of Doing Business

57. Law No. 6 of 2011 on Immigration (“Immigration Law”);

58. Law No. 13 of 2016 on Patent;

59. Law No. 20 of 2016 on Trademark and Geographic Indication;

60. Law No. 40 of 2007 on Limited Liability Company (“Company Law”);

61. Staatsblad of 1926 No. 226 jo. Statsblad of 1940 No. 450 on Nuisance (“Nuisance Law”) – REVOKED;

62. Law No. 7 of 1983 on Income Tax, as lastly amended by Law No. 36 of 2008 on Fourth Amendment of Law No. 7 of 1983 on Income tax;

63. Law No. 8 of 1983 on Goods and Services Value Added Tax and Luxurious Goods Sale Tax, as lastly amended by Law No. 42 of 2009 on Third Amendment of Law No. 8 of 1983 on Goods and Services Value Added Tax and Luxurious Goods Sale Tax;

64. Law No. 6 of 1983 on Taxation General Provisions and Procedures, as lastly amended by Law No. 16 of 2009 on Stipulation of Government Regulation in lieu of Law No. 5 of 2008 on Fourth Amendment of Law No. 6 of 1983 on Taxation General Provisions and Procedures;

65. Law No. 28 of 2009 on Regional Taxes and Retributions;

66. Law No. 7 of 2016 on Protection and Empowerment of Fishermen, Fish Cultivators and Salt Farmer;

67. Law No. 3 of 1982 on Mandatory Company Registration (“Mandatory Company Registration Law”) – REVOKED;

68. Law No. 6 of 2014 on Village; and

69. Law No. 5 of 1999 on Prohibition of Monopolistic Practices and Unfair Business Competitions (“Anti-Monopoly Law”).

Research and Innovation Support

70. Law No. 19 of 2003 on State-Owned Enterprise; and

71. Law No. 11 of 2019 on National System of Science and Technology.

Land Procurement

73. Law No. 2 of 2012 on Land Acquisition for Development for Public Interest; and

74. Law No. 41 of 2009 on Protection of Sustainable Agri-food Land.

Economic Zone

75. Law No. 39 of 2009 on Special Economic Zone (Kawasan Ekonomi Khusus);

76. Law No. 36 of 2000 on Enactment of Government Regulation In Lieu of Law No. 1 of 2000 on Free Trade Zone, as amended by Law No. 44 of 2007 on Enactment of Government Regulation In Lieu of Law No. 1 of 2007 on Amendment of Law No. 36 of 2000 on Enactment of Government Regulation In Lieu of Law No. 1 of 2000 on Free Trade and Free Port Zone; and

77. Law No. 37 of 2000 on Enactment of Government Regulation In Lieu of Law No. 2 of 2000 on Sabang Free Trade Zone.

Others

78. Law No. 30 of 2014 on Government Administration; and

79. Law No. 23 of 2014 on Regional Government, as lastly amended by Law No. 9 of 2015 on Second Amendment of Law No. 23 of 2014 on Regional Government.